Accounting for Shareholder Equity

Bookkeeping and Accounting for Shareholder Equity and T2 Preparation for Small Business in Canada

Introduction

Understanding the corporate balance sheet for purposes of the T2 preparation is important for a number of reasons. For instance:

- To reconcile the acquisition and disposition of capital assets;

- To understand what dividends may have been paid to shareholders;

- To make adjustments in respect of certain reserves or contingent amounts claimed on the financial statements, which may not be deductible for tax purposes;

- To assess the shareholder loan account; and

- To understand changes to the paid up capital and stated capital of the issued shares of the corporation.

To review, the balance sheet codifies the universal accounting equation, namely

SHAREHOLDER EQUITY = ASSETS – LIABILITIES

What is Shareholder Equity?

In a corporation, the shareholder’s equity might be classified into 3 separate pools. In the order of descending liquidity, they would be:

- Tax-paid shareholder loan account. This is money or property contributed to the corporation by the shareholder, repayable at its face amount with no further consequences. A tax paid shareholder loan can also arise in respect of remuneration or dividends declared as an amount payable to the shareholder, and “credited” to the shareholder loan account.

- Retained earnings of the corporation. This amount represents the cumulative tax paid corporate earnings of the company. Unlike the shareholder loan account, if the shareholder wishes to receive a distribution of the company’s retained earnings, the amount so paid to the shareholder would generally be in the form of a taxable dividend. That is, while the retained earnings of a company represents profits taxed at the corporate level, retained earnings have not been subjected to the personal tax rates of the shareholder. When such retained earnings are paid out, this second level of personal shareholder tax will apply.

- Share capital or stated capital. This amount can arise in a number of ways. Firstly, when a company is incorporated, shareholders will subscribe and pay for shares of the company that are issued to them. The amount of cash paid to acquire shares in a company is referred to as the “stated capital” of a corporation and is also generally the paid-up capital (“PUC”) of the shares for corporate tax purposes. PUC can be returned to a shareholder on a tax paid basis, because it effectively represents a return of original capital to the shareholder. However, this is not a very liquid option, as the return of PUC might require a redemption or cancellation of shares, with all of the incumbent legal documentation required to give the transaction effect.

However, shares of a corporation can also sometimes be issued at a stated capital or PUC which is significantly lower than their respective fair market value or redemption amount. This situation arises where a shareholder sells or transfers appreciated capital property to a corporation, and both parties jointly elect under the provisions of subsection 85(1), for the transfer to occur at the cost amount of the property to the transferor. In this case, consideration taken back by the transferor might include a shareholder loan (with hard ACB equal to the elected amount) plus shares representing the rest of the value and, however, with a nominal PUC and stated capital for tax purposes.

Such shares are typically referred to as Hi-Lo shares, because they have a HIGH redemption value, but a LOW paid up capital (PUC) and stated capital for tax and accounting purposes. If a Hi-Lo share is redeemed at its redemption value, it will result in the payment of a deemed dividend to the shareholder.

Consequently, share capital with a Hi-Lo characteristic can only be returned on a taxable basis to its shareholder.

What is a Dividend?

A dividend is a distribution of tax-paid corporate surplus and it is generally paid out of the tax-paid retained earnings of a corporation. Unlike the payment of a salary, bonus or director fee, a dividend is not deductible from the income of a corporation for tax purposes.

A dividend can only be paid to a person who owns shares of the particular corporation. The dividend is receivable by virtue of the right of ownership of such shares and must be paid on a pro-rata basis to all shareholders on a particular class of shares. Depending on the Articles of a Corporation, a dividend might be able to be paid on one particular class of shares to the exclusion of other classes of shares. However, all shareholders of that class on which a dividend is declared have a proportionate right and interest in such dividend.

How is a Dividend Taxed to the Shareholder?

A dividend is taxable to the recipient shareholder. An individual who receives a taxable dividend is entitled to claim a dividend tax credit (“DTC”) (federal and provincial), in computing personal taxes. The DTC is a mechanism which ensures that the same income is not taxed twice, since income earned will be taxed within the corporation and then again when paid to the individual as a dividend. The DTC mechanism creates a “tax credit”, to offset the tax already paid by a corporation.

An individual shareholder who receives a taxable dividend from a corporation is required to include the “grossed-up” amount of the dividend into taxable income. Depending on whether the dividend is an eligible or other than eligible dividend, the gross-up and dividend tax credit will differ, in order to integrate the effective corporate tax rate with the individual tax rate of the shareholder.

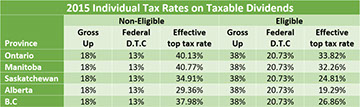

The following table summarizes the gross-up factor, dividend tax credit and effective top tax bracket rates of tax, on a provincial basis:

The Small Business Tax Rate is set to decrease each year up to and including 2019. As a result, non-eligible dividend tax credits will be revised as shown below to assist with integration:

*The Dividend Tax Credit on the above chart is shown as a % of the grossed-up dividend.

NOTE: Provincial Rates are also subject to change, but these rates are not available at the time of writing.

A corporation receiving a dividend from another corporation (payor corporation) is taxed quite differently than if the same dividend was received by an individual recipient. The tax consequences to the recipient corporation depend on whether the corporation is “connected” or not with the payor corporation.

What is “connected”?

A corporation is connected with another corporation under subsection 186(4) of the Act when the recipient corporation owns more than 10% of the voting shares, having a fair market value of more than 10% of all the shares of the payor corporation. Two corporations are also “connected” under subsection 186(2), when they are controlled by the same person or group of persons.

What is a Capital Dividend?

The capital dividend account (CDA) effectively represents the “tax-free” portion of capital gains realized by a corporation and the tax-free portion of proceeds received on the disposition of eligible capital property. A capital dividend is a tax free distribution of corporate surplus to a shareholder, paid from the corporation’s capital dividend account (CDA). A capital dividend can be paid only to the extent that there is positive balance in a corporation’s CDA. However, the CDA is a cumulative, running calculation and can also be a negative balance at a given point in time. The policy purpose behind the existence of the CDA is to preserve the concept of corporate/personal tax integration. By permitting the non-taxable portion of capital gains and eligible capital property to be paid out to the shareholder on a tax-free basis, this ensures that a shareholder is not tax disadvantaged as compared to a shareholder who receives the gain personally. An election to pay a capital dividend from a corporation’s capital dividend account must be filed in accordance with the provisions contained in subsection 83(2) of the ITA on form T2054.

What is Share Capital?

Share capital represents a shareholder’s equity in a corporation. This is a means by which a corporation can raise capital or equity to fund business operations. Typically, funds invested by a shareholder to acquire shares from the treasury of a corporation will become the least liquid form of capital to the shareholder. It can generally only be returned to the shareholder by either a share redemption or by a reduction of stated capital or paid-up capital (“PUC”), for income tax purposes.

Shareholders of privately owned Canadian-controlled private corporations typically will fund only a nominal amount of funds into share capital. Any accumulated capital that is necessary for the corporation can be provided by a shareholder loan instead.

A corporation will have the ability to organize its authorized share capital into different classes each with its own rights and privileges. In broad categories, the authorized share capital of a corporation could include the following:

- Common Shares

o Voting

o Non-voting

- Different classes of common shares

- Different series of the same class

- Preference Shares

o Voting

o Non-voting

- Redeemable, retractable

- Fixed value, based on property contributed for shares

- Nominal value

- Participating vs fixed or restricted dividend entitlement

What is Paid-Up Capital?

Paid-Up Capital (“PUC”) can generally be viewed as the tax basis on a share. For example, it is the amount of a corporation’s capital that has been actually funded by shareholders.

PUC is an essential concept relating to the tax attribute of the particular share, as it represents a tax basis to the shareholder. PUC can only be increased when an amount is paid in for that particular share; PUC is not increased when a share of a corporation is transferred or sold from one person to another.

Note: PUC is different from ACB as PUC refers to all shares of one class and ACB refers only to the shares owned by a particular shareholder. Paid up Capital is the value received by the corporation while the individual shareholder will have a different ACB depending on the value when issued.

Think of it this way:

Example - Paid Up Capital

Equity from Balance Sheet: $1 per share X 100 shares = Par value of stock = $100 $6 share value - $1 par value X 100 shares = $500 excess over par Paid-Up Capital = Par value of stock ($100) + Excess over par ($500) = $600

How Can Capital be Returned to the Owner?

For a shareholder of a private CCPC, the easiest way to return capital is by way of a repayment of a shareholder loan. Since funds contributed to a corporation by a shareholder, as a “shareholder loan” are tax paid when contributed, a repayment of such funds is simply a tax paid return of that capital.

Capital can also be returned to the shareholder when a corporation redeems, or repurchases for cancellation, shares held by the shareholder. The tax consequences of doing so will depend on the tax attributes of the shares being redeemed.

Consider the following examples:

Example - Share Capital

Preferred shares issued for:$100,000 cashPUC added to shares of:$100,000Redemption value:$100,000

A repurchase for cancellation of these shares will result in no deemed dividend to the shareholder because the redemption value equals the PUC of the shares. Effectively, the shareholder gets his original investment back and the shares are redeemed.

Example - Share Capital

Preferred shares issued for:$100,000 cashPUC added to shares of:$100,000Redemption value:$100,000

In this situation, a repurchase for cancellation of these shares will result in the payment of a deemed dividend of $99,000 to the shareholder, because the redemption amount of $100,000 exceeds the PUC of $1,000. The shares being redeemed in this situation would be described as Hi-Lo shares (High redemption value; Low paid up capital), and this type of share would typically have been issued on a “rollover basis”, when appreciated property was transferred to the corporation and part of the consideration taken back by the shareholder on the exchange was the Hi-Lo shares. The Hi-Lo shares contain the embedded tax liability deferred on the rollover. This is realizable only when such shares are redeemed or disposed of by the shareholder.

Share Redemptions and Deemed Dividends

As briefly outlined above, a corporation might redeem or repurchase for cancellation the shares that it issued to a shareholder. When the proceeds of disposition on the shares being redeemed exceeds the paid up capital of the shares, the excess is treated as a deemed dividend paid by the corporation. The deemed dividend reduces the tax paid retained earnings of the corporation.

If the person who receives proceeds on the redemption is an individual, the amount of the deemed dividend will be taxable to them and reportable on their personal income tax return. The payor corporation is required to issue a T5 slip to the recipient (whether an individual, corporation or trust) and to also file a T5 Summary on or before February 28th, following the calendar year in which the share redemption takes place.

If the person who receives proceeds on the redemption is a corporation, the amount of the deemed dividend will be reportable by the recipient corporation on Schedule 3 and potentially subject to Part IV tax. That is, if the corporations are not connected, Part IV tax with RDTOH treatment will apply. If the two corporations are connected, then Part IV tax will not apply, unless the payor corporation received a dividend refund on the payment of the deemed dividend and then only proportionately, to the extent of the recipient corporation’s share of the deemed dividend.

It is also possible for the payor corporation to make certain designations and elections in respect of any resulting deemed dividend arising on share redemption. For example, if the payor corporation has a balance in its GRIP account at the end of the taxation year in which the deemed dividend arises, the ayor corporation could designate a portion or the full amount of the dividend as an “eligible” dividend for tax purposes. The payor corporation can also elect that the deemed dividend be paid out of its capital dividend account (CDA). The result of this would be that the amount would be a tax-free dividend to the ecipient corporation, and also includable in its CDA for tax purposes. These are discussed in further detail in our GreenLearning article “Corporate Tax Integration”.

Shareholder Equity

Shareholder Equity can consist of two different and distinct forms and it is important to be able to differentiate between the two types of equity. In general, Shareholder Equity is comprised of the amount or value that the shareholders have invested into the corporation and can be returned to them without tax consequences or implications.

- Paid-Up Capital (PUC) as previously discussed, is the amount that the shareholder has paid to the corporation for shares. The shares have been purchased with personal after tax dollars and may be redeemed at the PUC amount without tax consequences.

- Shareholder Loans will sometimes exist and represent funds the shareholder has lent to the corporation. The corporation may repay these loans to the shareholder at any time with no tax implications and, as such, become current liabilities.

- In certain circumstances financial institutions may restrict a corporation from repaying outstanding loans to a shareholder until the financial institution has been repaid loans it has provided to the corporation. This is referred to as a covenant. In many cases this would necessitate that the shareholder loan amount be recorded in the Equity section of the financial statement as it is no longer a current liability.

Shareholder Loans, as a credit balance or liability of the corporation, represent no tax implications to either the corporation or the shareholder. Unfortunately, situations can occur when the shareholder loan becomes a debit balance – money owed by the shareholder to the corporation.

A Debit Balance in a shareholder loan account requires immediate attention – in short, the amount must be repaid or becomes income to the shareholder personally.

Capital Dividend Account (CDA)

For a private corporation only - This account is a sub-account of Retained Earnings and tracks the amounts that can be distributed to shareholders on a tax free basis. The balance within the CDA represents the non-taxable portion of any capital gain, less any capital losses.

Example: Sale of Capital Property

- Corporation buys land at $100,000

- Corporation sells land @ $140,000

- Capital Gain = $40,000

The taxable Capital Gain is $20,000. The amount that will be added to the CDA is the portion of the gain ($20,000) that is exempt from taxation under the 50% rule.

Cash Dividends

Cash Dividends are paid out of the corporation’s Retained Earnings account which represents the unrestricted surplus of cumulative earnings. Payment of cash dividends to a shareholder reduces this balance and results in the individual shareholder being taxed through a T5 slip.

- Payment of $10,000 to shareholder

- Zero tax deduction for corporation as it is paid from accumulated earnings (Retained Earnings)

- Individual shareholder is taxed and subject to the dividend gross up and dividend tax credit on their personal return.

GREENLEARNING PRACTICAL APPLICATION

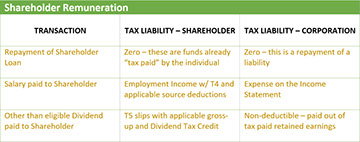

As a recap, the following chart shows different ways a shareholder can receive remuneration from a corporation and the tax implications of each. Use this as a reference guide.

DEFINITIONS

Paid-up Capital, (also called paid-in capital), is a measure of how much money investors have contributed (pumped in) to the corporation since the corporation’s inception in return for equity. This is recorded on the Balance Sheet.

Refundable Dividend Tax on Hand (RDTOH): Integration of non-active business income occurs through the use of the RDTOH account. 26 2/3% of non-active business income is included in the RDTOH account. This amount is refundable to the corporation at the rate of $1 for every $3 it pays out in taxable dividends (subsection 129(1)). The refund in any year is the lesser of:

- one-third of all taxable dividends paid out by the corporation in the year, and

- the amount in the RDTOH account.

We can assist you with advice and reporting as it relates to Shareholder Equity and preparation of your T2 for your small business. Here at Green Quarter Consulting - Accounting and Bookkeeping Services for Small Businesses in White Rock South Surrey, Vancouver, Langley and Surrey BC, we assist Small Business Owners with analyzing transactions, sources of income and your tax risks and how they relate to your specific business strategy. Learn more about our Greenstamp CFO Services here.

We can assist you with advice and reporting as it relates to Shareholder Equity and preparation of your T2 for your small business. Here at Green Quarter Consulting - Accounting and Bookkeeping Services for Small Businesses in White Rock South Surrey, Vancouver, Langley and Surrey BC, we assist Small Business Owners with analyzing transactions, sources of income and your tax risks and how they relate to your specific business strategy. Learn more about our Greenstamp CFO Services here.

Contact us today at 778-791-2864 or 604-970-0658, let’s talk, or send us an email here and we will be in touch very shortly.

GET YOUR FREE CONSULTATION TODAY