ACCOUNTING & BOOKKEEPING FOR Partnerships and Joint Ventures IN CANADA

How to Organize Bookkeeping & Accounting for Partnerships and Joint Ventures

Partnerships

A partnership is an unincorporated business relationship bringing together two or more people known as partners. Usually there is a partnership agreement between the partners although this need not be in writing. However, if there is no written agreement, the Provincial Partnership Act is implied and will be used to resolve any disputes among partners. This agreement deals with such matters as division of income, management responsibilities, transfer or sale of partnership interests, disposition of assets upon liquidation, and procedures to be followed in case of the death of one of the partners.

A partnership is an unincorporated business relationship bringing together two or more people known as partners. Usually there is a partnership agreement between the partners although this need not be in writing. However, if there is no written agreement, the Provincial Partnership Act is implied and will be used to resolve any disputes among partners. This agreement deals with such matters as division of income, management responsibilities, transfer or sale of partnership interests, disposition of assets upon liquidation, and procedures to be followed in case of the death of one of the partners.

The most common type of partnership is a general partnership where each partner is jointly and severally liable for the debts of the partnership. This means that one partner can be held responsible for all debts and obligations incurred in the name of the partnership business by another partner. A partner can also be held responsible for any wrongful acts or omissions by other partners acting in the ordinary course of the business. This unlimited liability can be a serious disadvantage in operating through a partnership.

The main advantage of using a partnership lies in the working relationship between the partners rather than in the legal structure of the enterprise. The most successful partnerships are those where the partners have complementary talents and are comfortable sharing their decision making. It’s very important to choose business partners carefully.

A limited partnership is an arrangement where a person can contribute to a business carried on in partnership without being involved in the affairs of the partnership. As a limited partner, the individual’s liability to the business or its creditors is limited to the amount the individual invested in the partnership. To remain a limited partner, the investor/partner must take no part in the management of the partnership or act on behalf of the partnership, or the partner will be considered a general partner. In some provinces, only certain kinds of businesses can operate as limited partnerships.

A limited partnership is created under provincial law and must file a certificate with the corporations’ branch (or its equivalent), in which it lists its limited partners and the capital they have contributed.

Partnerships do not file separate income tax returns and do not pay income tax, as the income of the partnership is combined with the personal or corporate income of the partners to determine their overall tax liability.

Accounting for a partner’s equity is like a sole proprietorship except that separate partner capital and drawings accounts are established for each partner.

General properties of partnership bookkeeping are as follows:

- Investments by each partner are credited to the partners’ capital accounts.

- Withdrawals from the partnership by a partner are debited to the respective drawing account.

- The net income for a partnership is divided between the partners as called for in the partnership agreement.

- The income summary account is closed to the respective partner capital accounts.

- The respective drawings accounts are closed to the partner capital accounts.

- After the closing process, the capital account of each partner is the amount of the cumulative investment by the individual partner, plus the partner’s cumulative share of all partnership earnings, less cumulative withdrawals by the partner.

The financial statements of a partnership follow the same format as those of a corporation except:

- The income statement includes an additional section entitled “Distribution of net income”.

- The partners’ equity section of the balance sheet is detailed for each partner.

- There is no income tax expense or income tax payable since each partner reports his or her share of the partnership profits on his or her individual (or corporate) tax return.

Partnership Transaction

There are certain transactions that are entered by partnership and their partners which are unique to this form of business structure. We will review the bookkeeping for some of these.

Contribution of Property

When a partnership is set up, the partners typically contribute property – including cash - to the partnership to establish its operations. (A partner need not contribute property. A partner may contribute services, including services to be provided in the future.)

From an accounting perspective, the contribution of property to a partnership by partner must be accounted for twice: it represents a disposition of the property by the partner and an acquisition of the property by the partnership. There are general principles which underlie the accounting for these transactions:

- For financial reporting purposes, both transactions should be accounted for at the fair market value of the property involved.

- The partner contributing the property will normally have to account for sales taxes that normally arise if the property is subject to tax.

- A partner and partnership can normally elect for income tax purposes to have the contribution of property accounted for at tax cost, so that the partnership takes over the partner’s tax cost of the property and the potential for capital gain or loss and/or recapture on a subsequent disposition. However, this election should not affect the bookkeeping for the transaction.

Recording the Contribution of Property

Fran and Ellen have decided to set up a partnership through which they will operate a retail store. Their arrangement calls for Fran to contribute $50,000 in cash and fixtures she already owns but which she was not using in a business, and which have a fair value of $25,000. Ellen has been carrying on a similar business as a GST-registered proprietor, and she is to contribute inventory worth $60,000. She has agreed to work in the store for no draw for three months to balance Fran’s contribution, so that Fran and Ellen will be equal partners. PST is charged at 8% in the province in which Fran and Ellen reside. The partnership records these transactions as follows: Contribution by Fran Contribution by Ellen

Contribution by Ellen Notes:Although Ellen and Fran have agreed to be equal partners, their capital accounts will not be the same as part of Ellen’s contribution is in the form of services. Partnerships do not account for the value of services provided by partners. There are no business or tax reasons for partners’ capital accounts to be proportionate. The contributions may give rise to an income tax liability for Ellen, depending on the cost of her inventory. If so, she and the partnership could elect to have the contribution accounted for at her tax cost. This election would not affect the bookkeeping for the contribution. Ellen would have to account for the disposition of her property in the financial statements of her proprietorship.

Notes:Although Ellen and Fran have agreed to be equal partners, their capital accounts will not be the same as part of Ellen’s contribution is in the form of services. Partnerships do not account for the value of services provided by partners. There are no business or tax reasons for partners’ capital accounts to be proportionate. The contributions may give rise to an income tax liability for Ellen, depending on the cost of her inventory. If so, she and the partnership could elect to have the contribution accounted for at her tax cost. This election would not affect the bookkeeping for the contribution. Ellen would have to account for the disposition of her property in the financial statements of her proprietorship.

Withdrawal of Property

A partnership cannot pay a salary or wage to a partner. When a partner withdraws cash or other property from a partnership, the partnership records the withdrawal as a disposition of that property and a debit to the partner’s draw account.

Typically, a partner draws cash. Where a draw is funded in kind, the partnership accounts for a disposition of the property at fair value. Sales taxes must be accounted for if they are otherwise due.

Recording Draws

Fran and Ellen have been quite successful. They agree that each will draw $20,000 from the partnership. Fran will take inventory with a cost of $12,000 but which is worth $15,000 and the balance in cash. Ellen will take her draw in cash. The partnership records these transactions as follows: Draw by Fran Draw by Ellen

Draw by Ellen

Disposition of an Interest

An interest in a partnership is a capital property, much like a share in a corporation, and it can be bought and sold separately. A purchase and sale of a partnership interest is a transaction solely between the partners involved. The capital account of the partner leaving is simply transferred to the new partner.

Tax Reporting

A partnership is not a person at law but is a relationship between the partners. For income tax purposes the net income of the partnership is computed as though the partnership were a person but is reported by and taxed in the hands of the partners, in the proportions they have agreed.

A partnership is, however, a person for purposes of registering for and collecting GST/HST and provincial retail sales tax. Thus, the accounting for these taxes is done at the partnership level and not by the partners.

Recovery of GST

The recovery of GST/HST paid on partnership expenditures where the partner and not the partnership incurs the outlay creates accounting complexity. The way in which these rules work depends on whether the partner is an individual and whether the partner is reimbursed by the partnership for the outlay.

Joint Arrangements – there are several changes in this section under new IFRS standards.

A joint venture is an arrangement between individuals, groups of individuals, partnerships or corporations working together in an undertaking that is not a permanent arrangement but more of a specific project. Usually, all participants of the project (joint venture) contribute assets, share risks, and have mutual liability. Once the project has been completed, the joint venture ceases to exist.

Generally, the participants in a joint venture name one participant to be the “joint venture operator”.

It is not always easy to distinguish between a partnership and a joint venture not the least reason for which is that the participants themselves may be very unclear about what type of relationship it is that they are trying to create. It may be necessary to obtain legal advice on what it is that has been created.

Differences between a partnership and a joint venture:

- A joint venture is not considered a “person” for any purposes. Thus, income for income tax purposes is not computed at the joint venture level but each venture severally, and a joint venture cannot register for and/or collect GST/HST or provincial retail sales taxes. As noted above, net income for income tax purposes is computed at the partnership level and a partnership registers for, collects and remits GST/HST and provincial sales taxes.

- Since a joint venture is not a person, it cannot own property. Specifically, a joint venture does not claim capital cost allowance; the ventures’ do.

Joint Venture Transactions

Despite the fact that a joint venture is never a person for any purposes, most joint ventures keep a set of accounts as though the joint venture were a partnership. This “accounting fiction” makes life a lot easier, because it allows transactions to be accounted for once by the venture rather than several times by the ventures’. It should be noted that although these accounts may be drawn up for any reporting period the parties choose, the joint venture itself is not a person and cannot have a year end, per se.

In the examples below we review how transactions are accounted for in practice and how they would be accounted for if the fact that a joint venture is not a person were recognized.

Recording Revenue

When a joint venture earns revenue, each venturer should account for its own share of the revenue. Technically, each venturer is required to make a separate determination as to whether sales taxes are to be collected.

Recording Revenue

Dr. Patel is a medical doctor. She has entered into a joint venture with Acme Corporation for the development of a strip shopping centre in which she has located her clinic. She has s 20% interest in the venture. Dr. Patel is not a GST registrant; Acme is. In the current period a tenant pays $10,000 in rent. The technically correct way to record this is: Dr. Patel Acme

Acme Joint Venture

Joint Venture

Expense recording follows the same principles: each venturer should technically report its share of each outlay. Practically, the joint venture maintains accounts and records the whole expenditure.

Contribution of Property

The contribution of property to a joint venture is a disposition of an interest in that property by the venturer, but only to the extent that the other venturers acquire an interest in the property. The venturer does not report a disposition of that portion of the property that continues to be owned through participation in the venture.

As with partnerships:

- For financial reporting purposes, the disposition should be accounted for at the fair market value of the property involved.

- The venturer contributing the property will normally have to account for sales taxes that normally arise if the property is subject to tax.

However, unlike a partnership, there is no election for income tax purposes to have the contribution of property accounted for at tax cost.

Recording the Contribution of Property

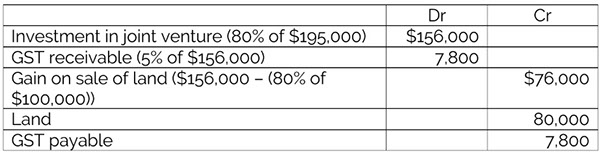

When the joint venture was established, Dr. Patel contributed the land she owned. The land cost $100,000 and had a fair value of $195,000. She was not paid for the land but Acme agreed to fund the entire construction cost, estimated to be $780,000, as its contribution to the venture. The technically correct way to record this is: Dr. Patel Acme

Acme Notes:The disposition of an interest in the land is subject to GST even though Dr. Patel is not a GST registrant. Again, it will be clear that while this accounting accurately reflects what is going on, it is quite cumbersome. So, the transaction will normally be accounted for on the books of the joint venture as follows: Joint Venture

Notes:The disposition of an interest in the land is subject to GST even though Dr. Patel is not a GST registrant. Again, it will be clear that while this accounting accurately reflects what is going on, it is quite cumbersome. So, the transaction will normally be accounted for on the books of the joint venture as follows: Joint Venture It is important to note that the value at which the joint venture accounts report the land is its fair value at the time it is contributed to the venture but that it does not represent the sum of the costs of the land to the two venturers.

It is important to note that the value at which the joint venture accounts report the land is its fair value at the time it is contributed to the venture but that it does not represent the sum of the costs of the land to the two venturers.

Disposition of an Interest

Unlike a partnership, where a disposition of an interest is a transaction between partners which does not affect the partnership accounts, a disposition of a joint venture interest is a disposition of an interest in the underlying property of the venture itself.

However, as noted above, where joint venture accounts are maintained, the values recorded in the joint venture balance sheet are generally not representative of the sum of the proportionate interests of the venturers. Since the value on the venture statement does not represent anything meaningful, joint ventures which keep accounts typically do not record the transfer of interests between the venturers.

Disposition of an Interest

Some time after the completion of the project, which is built exactly on budget, Dr. Patel sells 25% of her interest to her brother, Ram, for $65,000. At the time of sale, she has a 20% interest in the land, with a cost of $20,000 and a 20% interest in the building, with a cost of $156,000 (20% of $780,000). The transaction is recorded as follows: Dr. Patel Ram

Ram Notes:We have ignored GST, but Dr. Patel would normally have to charge GST to her brother. This transfer of interests would not normally be recorded in the accounts of the joint venture, which would continue to show the land having a cost of $195,000 – its fair value at the time it was contributed to the venture. In fact, though, the total cost of the land to the venturers is: Dr. Patel - $15,000; Ram - $7,386; Acme - $156,000, for a total of $178,381. Each venturer must keep track of its cost of investment separately, as the joint venture statements themselves are not representative. Similar principles apply to the carrying value of the building.

Notes:We have ignored GST, but Dr. Patel would normally have to charge GST to her brother. This transfer of interests would not normally be recorded in the accounts of the joint venture, which would continue to show the land having a cost of $195,000 – its fair value at the time it was contributed to the venture. In fact, though, the total cost of the land to the venturers is: Dr. Patel - $15,000; Ram - $7,386; Acme - $156,000, for a total of $178,381. Each venturer must keep track of its cost of investment separately, as the joint venture statements themselves are not representative. Similar principles apply to the carrying value of the building.

Tax Reporting

For income tax purposes, each venturer in a joint venture is supposed to compute its share of the net income of the venture separately, based on the taxation year of the venturer.

The CRA will typically allow a joint venture which keeps accounts to prepare an annual financial statement and allow the venturers simply to pick up their proportions of the net income so calculated, provided this does not result in an undue deferral of the recognition of income. However, a joint venture that keeps accounts can never claim capital cost allowance – only a venturer can. As accounts of the joint venture do not reflect the total cost of the underlying property to the venturers, a joint venture would typically not be able to compute CCA with any accuracy anyway.

Tax Reporting

Dr. Patel and Ram, as individuals, have December 31 fiscal year ends. Acme has a year end of June 30. Technically, Acme should account for its share of the joint venture operations for periods which start on July 1 and end on June 30 while Dr. Patel and Ram should account for joint venture operations on a calendar year basis. Administratively, the CRA will typically allow the joint venture to prepare one set of financial statements which all of the venturers use to report operations. For example, if the venture prepares December 31 statements, Acme would report its share of joint venture income based on the statements for the December that falls before its June year end.

GST Accounting

GST accounting for a joint venture can be a nightmare because the joint venture itself is never permitted to register, collect or remit tax. Each venturer must make a separate determination as to whether tax is due and calculate and remit the tax individually. As noted in an earlier example, this can be very problematic indeed where one or more of the venturers is not required to charge tax and another is.

In recognition of this, certain joint ventures (but not all!) are permitted to make a so-called ‘operator election’. Where this election is made one participant in the venture accounts for GST as though all joint venture supplies were made and all inputs were purchased by the operator. The election therefore pushes the GST accounting to the operator.

Where the election is made, however, the other participants in the venture remain jointly and severally liable for any net tax and interest or penalties that may arise.

SUMMARY

- Both partnerships and joint ventures are undertakings involving two or more participants. It is a question of fact as to whether an arrangement is a partnership or a joint venture.

- A partnership is treated as a person for bookkeeping purposes, and for purposes of computing net income for tax purposes and collecting sales taxes.

- A joint venture is not a person for any purpose. However, a joint venture often keeps accounting records as though it were, in effect, a partnership.

- Since a joint venture is not a person for any purpose it cannot have a year end.

- Special GST accounting issues arise when dealing with both partnerships and joint ventures.

We can assist you with the ins and outs of accounting and bookkeeping for your Partnerships or Joint Venture in Canada. Here at Green Quarter Consulting - Accounting and Bookkeeping Services for Small Businesses in White Rock South Surrey, Vancouver, Langley and Surrey BC, we assist Small Business Owners with analyzing transactions, sources of income and your tax risks and how they relate to your business strategy. Learn more about our Greenstamp CFO Services here.

We can assist you with the ins and outs of accounting and bookkeeping for your Partnerships or Joint Venture in Canada. Here at Green Quarter Consulting - Accounting and Bookkeeping Services for Small Businesses in White Rock South Surrey, Vancouver, Langley and Surrey BC, we assist Small Business Owners with analyzing transactions, sources of income and your tax risks and how they relate to your business strategy. Learn more about our Greenstamp CFO Services here.

Contact us today at 778-791-2864 or 604-970-0658, let’s talk, or send us an email here and we will be in touch very shortly.

GET YOUR FREE CONSULTATION TODAY